The Ultimate Home Enhancement Option: Cellar Underpinning Discussed

Advantages of Cellar Foundation

Undoubtedly, among the vital advantages of basement support is its ability to substantially raise the usable area and worth of a residential or commercial property. By reducing the cellar flooring, underpinning enables the production of greater ceilings, making the location more inviting and practical for different usages such as added space, bedrooms, or leisure spaces. This makeover not just improves the general living experience for the owners however additionally includes considerable value to the residential property.

In addition, cellar underpinning can attend to architectural problems and reinforce the foundation of a structure, ensuring its long-lasting stability and longevity. This procedure can fix troubles like splits, irregular floorings, or drooping wall surfaces, consequently boosting the architectural stability of the entire residential property.

In enhancement to the functional benefits, basement foundation also offers the opportunity to improve the area and personalize according to the property owner's preferences and lifestyle. Bench Footings Toronto. Whether it includes producing a home theater, a health club, or a large home office, the flexibility provided by underpinning enables limitless opportunities in optimizing the capacity of the cellar location

Process of Underpinning Cellars

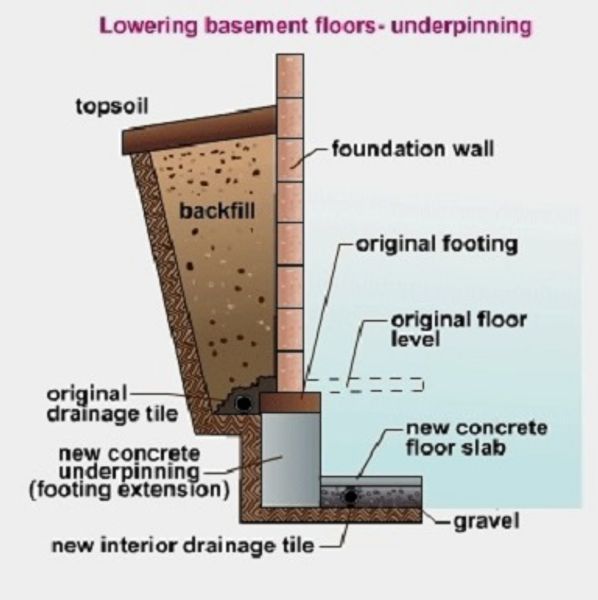

Basement underpinning entails a series of strategic and specific building and construction methods targeted at enhancing the structure of a building and increasing the deepness of its basement. The process generally starts with an assessment by architectural engineers to establish the certain needs of the structure. Next off, the area around the existing structure is excavated in areas to permit for controlled access to the foundation grounds. Temporary assistances are then installed to ensure the security of the structure during the underpinning procedure.

When the initial prep work are total, the existing foundation is incrementally underpinned by reducing the cellar flooring level and creating brand-new, deeper footings under the existing ones. The underpinning procedure is completed by backfilling the dug deep into location and restoring the cellar to its initial or enhanced state.

Architectural Considerations for Underpinning

When taking into consideration cellar foundation, crucial architectural aspects need to be meticulously evaluated to make sure the honesty and safety and security of the building's foundation. One vital factor to consider is the existing foundation's condition. A detailed assessment by an architectural designer is necessary to recognize any weaknesses, cracks, or indications of degeneration that might require to be resolved throughout the underpinning procedure. Additionally, the load-bearing capacity of the soil beneath the foundation should be evaluated to figure out if it can sustain the extra weight of the base.

One more structural consideration is the deepness and kind of foundation required. The deepness of the base will rely on numerous variables, consisting of the existing foundation's deepness and the preferred basement elevation. Different sorts of support, such as mass concrete base or mini-piled underpinning, might be suggested based on the details structural needs of the structure.

Price Factors to Consider

Considering the economic ramifications of basement underpinning is critical for building owners looking to enhance their structure's structural honesty. The very first factor to take into consideration is the dimension and depth of the support needed to meet the architectural needs of the structure.

Another crucial expense factor is the condition of the existing structure. The general project expense will certainly rise if there are pre-existing architectural issues or damage that requires to be dealt with prior to underpinning can take place. Furthermore, the accessibility of the website can influence costs. Restricted access for heavy equipment or obstacles in carrying products to the basement area might call for extra labor or specific tools, including in the total costs.

Last but not least, the knowledge and track record of the underpinning service provider will certainly affect costs. Highly competent experts with a record of effective underpinning jobs might charge higher charges however can offer assurance of high quality craftsmanship and structural integrity. It is recommended to obtain multiple quotes and thoroughly evaluate the cost breakdown prior to waging cellar base to make sure a sensible budget plan and successful project completion.

Selecting a Professional Underpinning Professional

Given the critical duty that the problem of the existing foundation plays in identifying project prices, picking an expert underpinning professional becomes extremely important for making sure the success of the basement underpinning endeavor. When picking an expert underpinning professional, there are several vital aspects to consider. To start with, make sure the professional has the essential experience and experience in underpinning jobs. Look for service providers who have a proven record of successful cellar underpinning projects and can supply references for their job. Additionally, it is critical to confirm that the contractor is try this certified, insured, and bound to protect on your own from any obligation.

Furthermore, interaction is vital when working with an underpinning specialist. By very carefully choosing an expert underpinning specialist, you can make sure that your cellar underpinning job is completed successfully and to your satisfaction.

Conclusion

In final thought, basement support offers numerous benefits for home owners looking to boost living space and structural security. In general, cellar foundation is a very effective option for boosting the value and capability of a residential or commercial property.

Cellar underpinning includes a collection of precise and tactical building and construction techniques aimed at reinforcing the foundation of a building and boosting the deepness of its cellar.When considering basement base, key structural elements need to be meticulously evaluated to make sure the honesty and safety and security of the building's foundation (toronto basement underpinning). Different types of foundation, such as mass concrete base or mini-piled base, might be advised based on the details structural requirements of the building

Considering the financial implications of basement foundation is important for building proprietors looking to boost their structure's architectural honesty.In verdict, cellar base uses many advantages for house owners looking to boost living area and structural stability.